Learn about the tax obligations and rights of corporations partnerships trusts and organizations that carry out activities in Québec. If you notice that the tax deduction previously withdrawn from your monthly pension is too high you can ask to have it reduced.

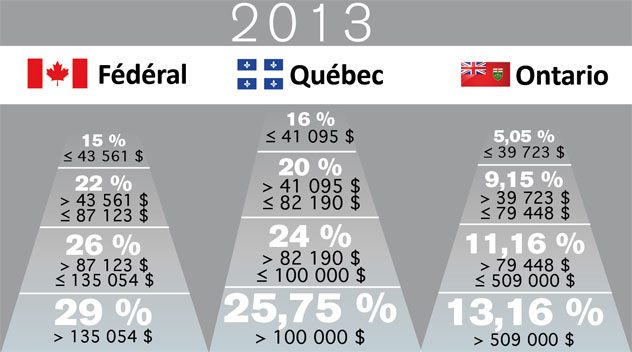

200116 2016 PERSONAL INCOME TAX RATES - QUÉBEC Marginal rate Taxable income Federal.

Impot federal quebec. The Government of Quebec develops and administers its own tax laws and policies. If you live in the province of Quebec you may need to file a separate provincial income tax return. For more information visit Revenu Quebec.

For non-eligible dividends table takes into account the gross-up of 15 the federal tax credit of 903 and the provincial tax credit of 401. Title Table dimpôt 2020 Particuliers Québec. Complaints continue to drop at Revenu Québec.

Learn about income tax returns consumption taxes and the programs and credits for individuals self-employed persons and members of a partnership. Learn about the tax obligations and rights of corporations partnerships trusts and organizations that carry out activities in Québec. Each bracket pays a different rate of tax as the table below shows.

2020 Federal income tax brackets. 2020 Federal income tax rates. Services includes the following.

-

Preparation of your Federal and Quebec Tax Returns T4-RL1. - Calculating your GST and solidarity credit. - Registering for direct deposit.

-

Registration of your medical expenses donations. - Submit Your Tax Retune Electronically to Revenue Canada and Revenue Quebec. To compensate for this federal personal income taxes on income earned in Quebec are reduced by 165 of federal tax.

This is referred to as the Quebec Abatement. Personal federal marginal tax rates. The following historical federal marginal tax rates of the Government of Canada come from the website of the Canada Revenue Agency.

They do not. OTTAWA Quebec Premier François Legault will have to wait longer before Quebecers can see a single tax filing process administered by Revenue Quebec. Advertisement Story continues below.

The document has moved here. Federal. Goods.

Estate. Non-eligible dividends up to 32689 are not subject to federal taxation and up to 22060 are not subject to provincial taxation. Eligible dividends up to 55489 are not subject to federal taxation and up to 35835 are not subject to provincial taxation.

200116 2016 PERSONAL INCOME TAX RATES - QUÉBEC Marginal rate Taxable income Federal. Form Personal Tax Credits Return TD1 Line 3 Age amount. If you will be 65 or older on December 31st of the current year you can claim a personal tax credit if your net income for the year from any source is under the threshold set by the Canada Revenue Agency.

Non-eligible dividends up to 33143 are not subject to federal taxation and up to 24018 are not subject to provincial taxation. Eligible dividends up to 56263 are not subject to federal taxation and up to 39087 are not subject to provincial taxation. 221117 2017 PERSONAL INCOME TAX RATES - QUÉBEC Marginal rate Taxable income Federal.

Préparation des déclarations dimpôt des particuliers T1 TP1 du 1 Février au 30 Avril Bureau ouvert 7jours 7 du 1 Mai au 31 Janvier sur rendez-vous seulement 418-668-4159. Calculate your combined federal and provincial tax bill in each province and territory. Calculate the tax savings your RRSP contribution generates.

Canadian corporate tax rates for active business income. 2021 - Includes all rate changes announced up to June 15 2021. The official website of the Gouvernement du Québec.

An evolving website designed according to users needs. Québec is the only province in Canada that must file 2 separate tax returns. One federally to the Canada Revenue Agency CRA and one provincially to Revenu Québec RQ.

They have their own unique forms and schedules and certain rules apply only to this province. Reduce your additional tax deductions. If you notice that the tax deduction previously withdrawn from your monthly pension is too high you can ask to have it reduced.

Please fill out the section Additional tax to be deducted on page 2 of the Canada Revenue Agency form Personal Tax Credits Return TD1. Federal. Goods.

Estate. To file your GSTHST goods and services tax or harmonized sales tax and your QST Québec sales tax returns online. Access Service for filing the GSTHST and QST return Submit a consumption tax rebate application.

The monthly amount of your additional tax deductions currently withdrawn from your pension is 200 and this excluding your basic tax. You wish to add 100 to the amount of deductions already withdrawn. Thus the new amount for the current year will be 300.

On the form you must enter the amount of 300 in the box provided. This new amount. Thus the new amount for the current year will be 150.

On the form you must enter the amount of 150 in the box provided. This new amount will replace the amount of 200. Your new additional tax deductions will be 150 and this excluding your basic tax.

Notice to disabled persons. The document has moved here. Basic federal rate 38 Provincial abatement 10 Federal rate before deductions 28 General rate reduction or MP deduction 131 Federal rate 151 ProvincialTerritorial Combined Alberta2 115 265 British Columbia3 12 27 Manitoba 12 27 New Brunswick4 14 29 Newfoundland and Labrador5 15 H 30 Northwest Territories 115 265.

The forms presented in this page will allow you to get support payments andor child care expenses tax deductions from your monthly pension. To obtain the deductions you must fill out the forms presented in this page. In the case of federal tax you must fill out the form Request to Reduce Tax Deductions at Source for year s T1213 and send.