Contributions are collected by Revenu Québec and managed by the Caisse de dépôt et placement du Québec. J anuary 1952 saw the beginning of the countrys first universal old age pension Old Age Security for people 70 years of age and over.

Administered by Retraite Québec.

Revenu pension quebec. Click Coronavirus Disease COVID-19 to see whether the measures adopted by Revenu Québec apply to the information on this page. If you have an employee who is 18 or older both you and the employee must contribute to the Québec Pension Plan QPP. In 2021 the contribution rate for Québec Pension Plan is 100.

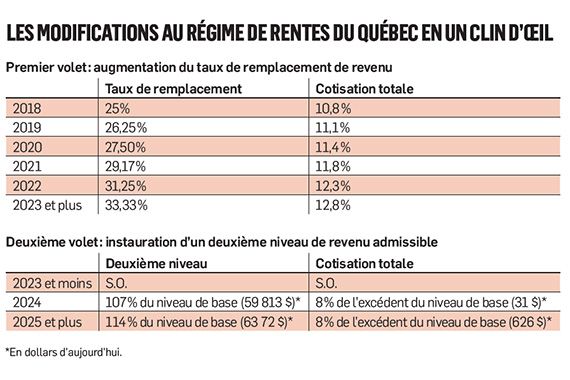

That rate is split equally between the employer and the employee. Those contributions will gradually increase from 2019 to 2025. Contributions are collected by Revenu Québec and managed by the Caisse de dépôt et placement du Québec.

If all or part of the pension is exempt from income tax under a tax treaty or an agreement concluded between the country in question and Québec or Canada you can claim a deduction for income exempt under a tax treaty. The International Tax Services Office of the Canada Revenue Agency can provide information on tax treaties and agreements. The indexation rate is set according to the rise in the cost of living as established by Retraite Québec on the basis of information provided by Statistics Canada.

Pension indexing ensures that beneficiaries maintain the same purchasing power. In January 2021 for example pensions under the Québec Pension Plan were increased by 10. Revenu Québec authenticates your identity because it has a lot of information that allows us to apply the laws that cover the Québec Pension Plan and the refundable tax credit for Family Allowance.

Workers in Quebec contribute towards the Quebec Pension Plan QPP not the Canada Pension Plan CPP. All employees and self-employed workers over the age of 18 are required to make QPP contributions if their income is more than 3500. This 3500 basic exemption amount is the same as the CPP.

Canada Child Benefit For 2020 the federal government has provided a supplement of 300 per child in addition to the Canada child benefit for the month of May. For 2021 families with a net income of less than 120 000 will receive 1 200 per child under the age of six. For families with an income of 120 000 or more this amount will be 600.

29 Remittances made to Revenu Québec include all of the following except. Québec Pension Plan contributions B. Federal income tax deductions C.

Québec Parental Insurance Plan premiums D. Provincial income tax deductions 30 According to Revenu Québec rules taxable benefits should be charged to employees. Each pay period as they are enjoyed or received B.

Within one month of being. Statutory deductions reported on the slips and the employers portion of Québec Pension Plan Québec Parental Insurance Plan contributions to the health services fund and compensation tax if applicable are credited to the employers Revenu Québec account. This form makes it possible for you to designate a person to act on your behalf with regard to your benefits under the Québec Pension Plan or a public-sector pension plan.

Application for a Pension Estimate. Application for Retirement Pension Under a Public-Sector Pension Plan. As a result of Quebec Pension Plan QPP enhancements as of January 1 2019.

Which you can get from Revenu Québec. You may have a place of business in Quebec and in another province or territory. As of January 1 2019 if you transfer an employee from Quebec to another part of Canada before the end of the year you must use a new formula.

Revenu Québec uses the word. For the purposes of tax deductions credits and transfers related to the Québec Pension Plan public-sector pension plans and supplemental pension plans the Quebec government only recognizes de-facto partners or common-law spouses if you have lived together for at least three years. The net salary which is the amount on the employees paycheque is the amount received after payroll and income taxes have been deducted.

Included in the amounts that are deducted from your gross pay are contributions to the Canada Pension Plan or CPP which in Quebec is referred to as the Quebec Pension Plan or QPP. Use Revenu Québecs online change of address service de Revenu Québec. Pensions from a foreign country.

Administered by Retraite Québec. Find out about the various ways to provide your new address to Retraite Québec. Savings and retirement products.

Administered by Épargne Placements Québec. Use the Online Transactions. Revenu Quebec offers a range of credits for seniors.

If you report qualifying retirement income on your return you may qualify to claim a non-refundable credit. Eligible Income To claim this amount you or your spouse must report income on lines 122 or 123 of your Quebec income tax return. Line 122 is reserved for.

Canada Pension PlanQuebec Pension Plan 4 calculated CPP the individual would have received up to a maximum of 2500. 2 The survivor pension is a monthly pension paid to the deceased contributors spouse or common-law partner. The amount received depends on several factors including.

The most important criterion used by Revenu Quebec in determining whether a worker is an employee or is self-employed in Quebec. IN RECEIPT OF RETIREMENT PENSION UNDER QUEBEC OR CPP NOT IN RECEIPT OF DISABILITY BENEFITS FROM QUEBEC OR CPP 70 YEARS OF AGE OR OLDER. The death benefit granted under the Québec Pension Plan is a lump-sum payment that can total up to 2500.

It is paid if the deceased contributed sufficiently to the Québec Pension Plan. It is paid on a priority basis to the person who paid the funeral expenses. Revenu Québec also maintains a register of unclaimed property that you can.

Québec Fonds des pensions alimentaires Ministère du Revenu 3800 rue de Marly Sainte-Foy Québec G1X 4A5 Montréal Fonds des pensions alimentaires Ministère du Revenu C. 4000 succursale Desjardins Montréal Québec H5B 1A5 IN-902-V2003-03 4103 1031 AM Page 12. 13 You may also remit source deductions of.

See Revenu Québec website for complete list. 007 Contribution to the Workforce Skills Development and Recognition Fund commonly known as the 1 law 1 of payroll if it is greater than 2 million. Commission des normes de léquité de la santé et de la sécurité du travail.

J anuary 1952 saw the beginning of the countrys first universal old age pension Old Age Security for people 70 years of age and over. It also saw the first payments flow from the accompanying program the income-tested Old Age Assistance for 65 to 69-year-olds. Both Old Age Security and Old Age Assistance were subject to a 20-year residency requirement and started with benefits of 40 per.

Caisse de dépôt et placement du Québec CDPQ. Quebec Deposit and Investment Fund also referred to in English-language media as the Caisse is an institutional investor that manages several public and parapublic pension plans and insurance programs in QuebecCDPQ was founded in 1965 by an act of the National Assembly under the government of Jean Lesage.